Selloffs in Dangote Cement, MTN drag NGX index down by 3.15%, Naira dips by 3.8% at NAFEX

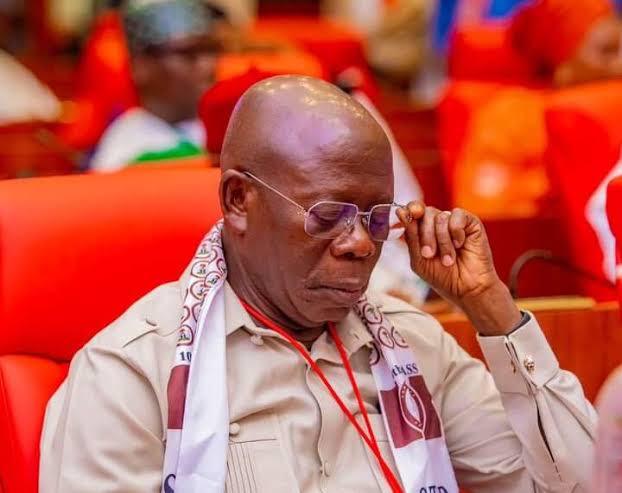

Cement manufacturers have agreed to bring down the price of the product from N10, 000 to between N7, 000 and N8, 000 per 50kg provided some conditions are met by the Federal Government.

The decision was reached at a meeting convened by the Minister of Works, David Umahi.

Umahi had invited cement manufacturers to a meeting in Abuja after the price hit the roof, going as high as N15, 000 in some places.

Speaking after the meeting also attended by Doris Uzoka-Anite, his Industry, Trade and Investment counterpart, Umahi said manufacturers listed bad roads, high energy costs, Forex crisis as some of the factors responsible for the hike.

“The cement manufacturer has noted to the government that the present high cost of cement in the market is very much abnormal in some locations nationwide. Ideally, they noted that cement price, and retail price to a consumer should not cost more than between N7, 000 to N8, 000 per 50 kg bag of cement.

“Therefore, the government and the cement manufacturers, which are Dangote Plc, BUA Plc and Lafarge Plc have agreed to have their cement price nationwide between N7, 000 and N8, 000 naira per 50 kg pack of cement, depending on the locations, which means that this price depends on the locations.”

Selloffs in Dangote Cement, MTN drag NGX index down by 3.15%, Naira dips by 3.8% at NAFEX

Meanwhile, offload of the shares of heavyweight stocks, Dangote Cement Plc and MTN Nigeria Plc by investors, dragged down the benchmark index of the Nigerian Exchange Limited by 3.15 percent on Monday.

This is as the market capitalization shed N1.82trn to close at N56.03 trn as a result, the ASI year-to-date return fell to 36.94 percent.

Opening the week, the local bourse lost 3.15 percent as the benchmark Index settled at 102,393.23 points.

“Selloffs of industrial heavyweight, DANGCEM (-10.00%) alongside MTNN (-10.00%) and ZENITHBANK (-0.28%) offset gains in GEREGU (+5.44%), TRANSCORP (+4.55%) and FIDELITYBNK (+0.94%).”

Analysis of Monday’s market activities showed trade turnover settled lower relative to the previous session, with the value of transactions down by 7.58 percent. A total of 273.85m shares valued at N7.44bn were exchanged in 9,688 deals. GTCO (+0.00%) led the volume chart with 28.85m units traded while GEREGU (+5.44) led the value chart in deals worth N1.74trn

Market breadth closed negative at a 2.25-to-1 ratio with declining issues outnumbering the advancing ones. DANGCEM (-10.00%) topped thirty-five (35) others on the laggard’s table while DAARCOMM (+8.64%) led fifteen (15) others on the leader’s log.

Similarly, the naira depreciated by 3.8 percent to N1, 598.54/$ at the Nigerian Autonomous Foreign Exchange Market.

The overnight lending rate expanded by 57bps to 17.5 percent, in the absence of any significant funding pressure on the system.

The Nigerian Treasury bills secondary market traded with bullish sentiments, as the average yield declined by 3bps to 15.4 percent. Across the curve, the average yield contracted across the short (-1bp), mid (-2bps) and long (-5bps) segments, following demand for the 80 DTM (-2bps), 171DTM (-2bps) and 353DTM (-30bps) bills, respectively. Similarly, the average yield declined by 3bps to 17.8 percent in the OMO segment.

Trading in the FGN bonds secondary market was calm, as market participants shifted focus to today’s FGN bond auction. Consequently, the average yield was unchanged at 16.2 percent.